Under the current legislation the income tax structure for resident individuals is based on progressive tax rates ranging from 0 to 28 on chargeable income. Reduction of certain individual income tax rates.

Why It Matters In Paying Taxes Doing Business World Bank Group

For residents tax is paid on a sliding scale - so the more you earn the more tax you pay - but theres a cap of 28 percent.

. Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 3 Earning Stripping Rules. Corporate tax rates for companies resident in Malaysia is 24.

In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. Charged and the income tax payable by an individual or tax repayable. EIS is not included in tax relief.

Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018 Highlights. On the First 5000. Income tax is managed by the Inland Revenue Board of Malaysia which determines how much tax is paid on ones income.

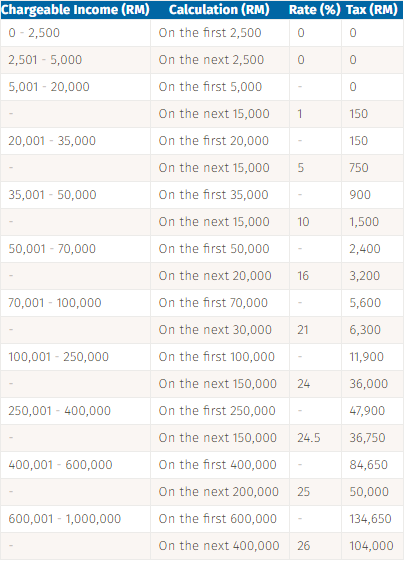

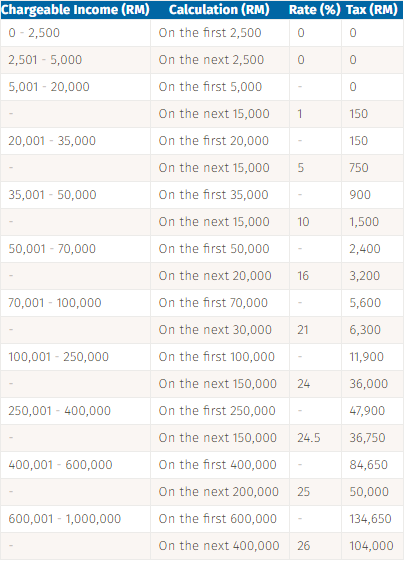

23 rows Tax Relief Year 2018. Calculations RM Rate TaxRM. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower.

Corporate companies are taxed at the rate of 24. 5 December 2018 Page 1 of 39 1. Theres a lower limit of earnings under which no tax is charged - and then a progressively higher tax rate is applied based on how much you earn above that level.

Malaysia Personal Income Tax Rate. 50 income tax exemption on rental income of residential homes. Source 1 Source 2 22 Dec 2017 What is.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Basic supporting equipment for disabilities self spouse children or parents Covers equipment to aid with disabilities including wheelchairs and artificial legs. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking.

Malaysia has a fairly complicated progressive tax system. Based on this table there are a few things that youll have to understand. There are a total of 11 different tax rates depending on your.

All non-residents are taxed at a flat rate of 28 percent. 1 Corporate Income Tax 11 General Information Corporate Income Tax. Expense in connection with or on any.

8 EPF contribution removed. Malaysia Non-Residents Income Tax Tables in 2019. A new legislation has been proposed to effect the Earning Stripping Rules ESR in replacing the thin capitalisation legislation.

What are the income tax rates in Malaysia in 2017-2018. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA.

Self and dependents. Budget 2019 Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018 Tax Espresso Special Edition. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and belowor 2.

On the First 2500. Similarly those with a chargeable. First of all you have to understand what chargeable income is.

Chargeable income is your taxable income minus any. The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below. Update of PCB calculator for YA2018.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. 13 September 2018 Page 1 of 14 1.

Income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. 20182019 Malaysian Tax Booklet Income Tax.

Official Jadual PCB 2018 link updated. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. A Limited Liability Partnership LLP resident in Malaysia with.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. Microsoft Windows 81 service pack terkini Linux atau Macintosh.

20182019 Malaysian Tax Booklet 8 Classes of income Income tax is chargeable on the following. Assessment Year 2018-2019 Chargeable Income. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking.

Removed YA2017 tax comparison. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. Calculations RM Rate TaxRM 0-2500.

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Income tax rate Malaysia 2018 vs 2017. Every taxpayer is entitled to a default relief of RM9000.

For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. Here are the tax rates for personal income tax in Malaysia for YA 2018. The amount of tax relief 2018 is determined according to governments graduated scale.

B deduction of tax from special classes of income. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the. Dimaklumkan bahawa pembayar cukai yang pertama kali.

62018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Does not cover spectacles and optical lenses. Income Tax Rates and Thresholds Annual Tax Rate.

Employment Insurance Scheme EIS deduction added. Objective The objective of this Public Ruling PR is to explain the computation of income tax and the tax payable by an individual who is resident in Malaysia. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Income Tax Malaysia 2018 Mypf My

How To Pay Zero Tax For Income Up To Rs 12 Lakh From Salary For Fy 2018 19

Cukai Pendapatan How To File Income Tax In Malaysia

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

Malaysia Tax Revenue 1980 2022 Ceic Data

Gst In Malaysia Will It Return After Being Abolished In 2018

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Individual Income Tax In Malaysia For Expatriates

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

What Happens When Malaysians Don T File Their Taxes Update